Ideal Tips About How To Appeal A Wage Garnishment

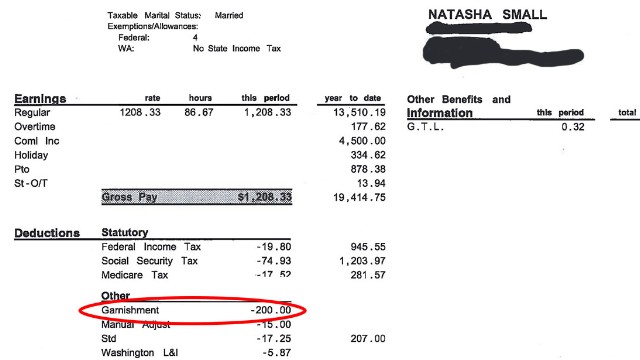

All the salaried employees are subject to wage garnishment.

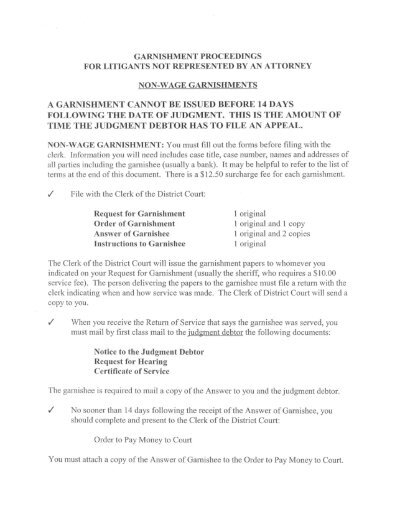

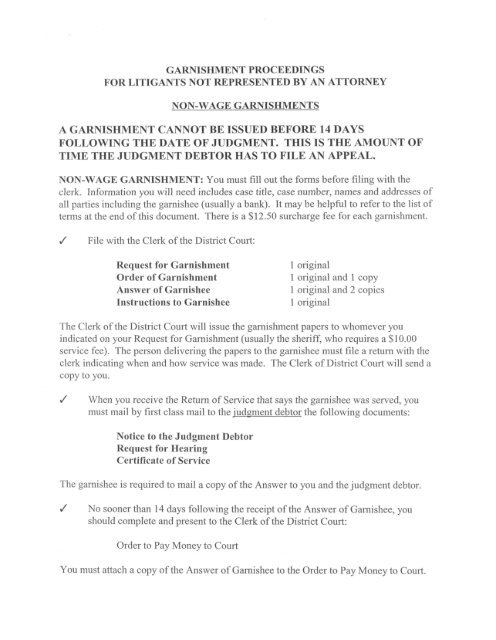

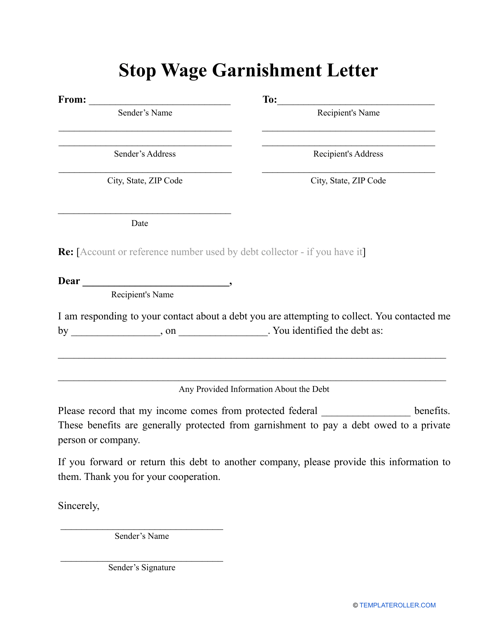

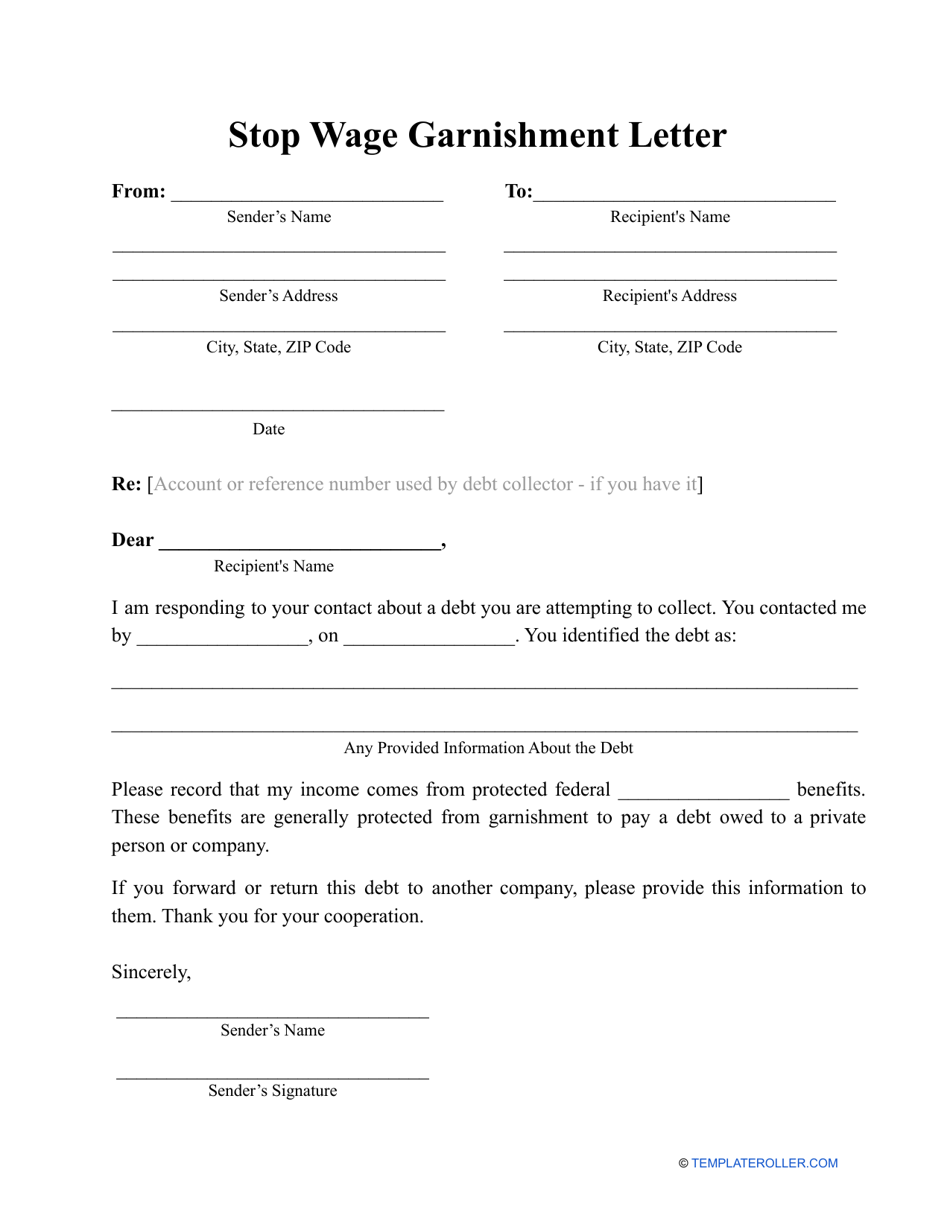

How to appeal a wage garnishment. First, you could attempt to negotiate a monthly payment agreement with. Paycheck stubs and bank statements must be provided to. Challenge the wage garnishment lawsuit in court.

Salaries, bonuses, and even the retirement plan income can be garnished if the individual has a debt. If your wages are to be garnished, your employer is required by law to inform you of your right to protest the garnishment. Bring all the evidence (wage garnishment worksheet, any supporting documents, etc.) you need to support your objection with you to court on your court date.

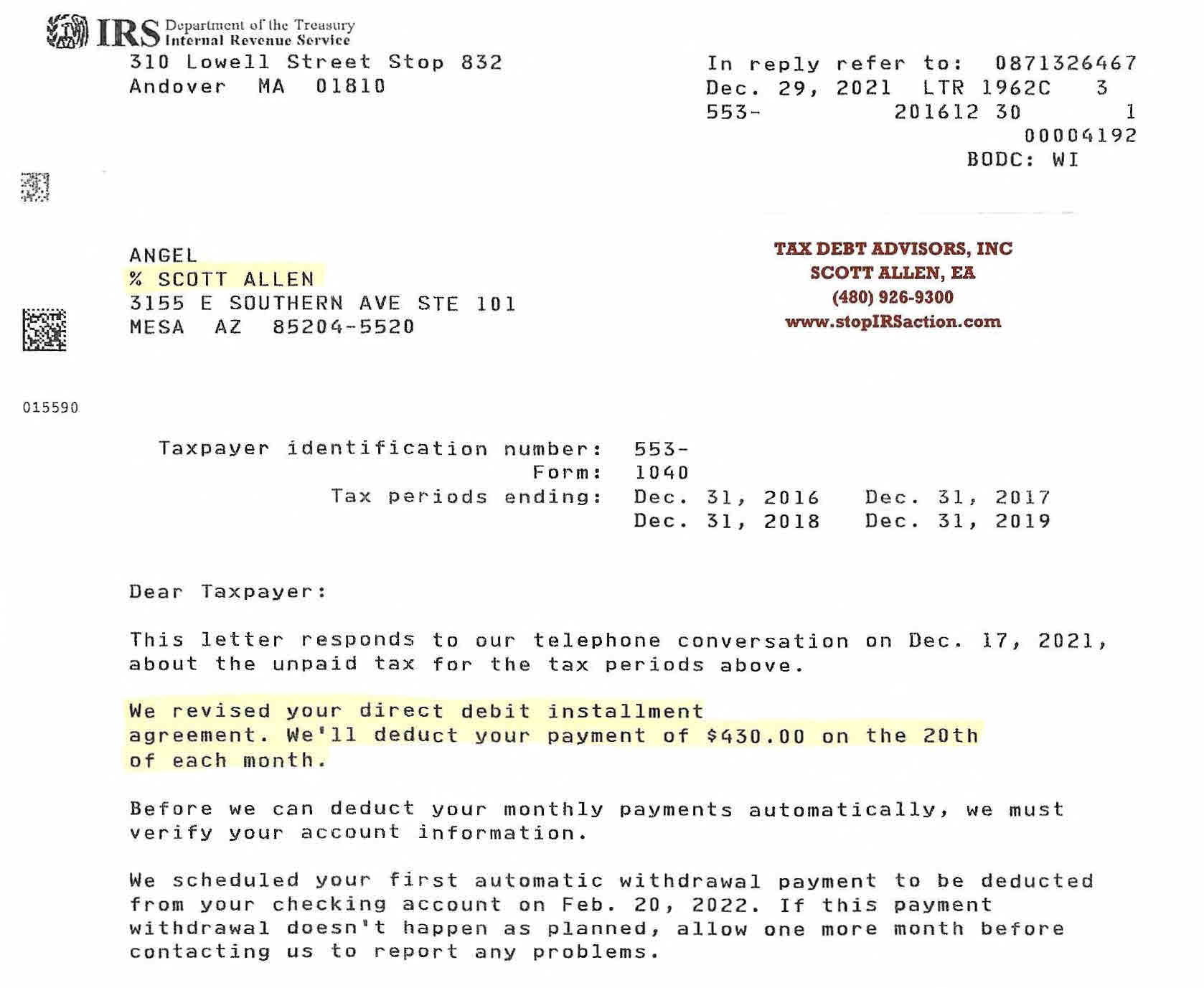

If you want to know how to stop wage garnishment, get help from our experienced montgomery wage garnishment lawyer at grainger law firm. If you disagree with the irs over the amount of taxes you owe, you can file an appeal with them. Up to 25% cash back the procedures you need to follow to object to a wage garnishment depend on the type of debt that the creditor is trying to collect, as well as the laws of your.

Maryland’s laws vary depending on the county in which you live. The federal wage garnishment law is title iii of the consumer credit protection act (ccpa). Work with your tax attorney to determine how to file an.

If you need an interpreter or an. Up to 25% cash back you'll have to follow somewhat different procedures if you wish to object to the wage garnishment, depending on who's trying to garnish you. At a minimum, you will.

See if you qualify for irs fresh start (request online).