Who Else Wants Info About How To Recover From Debt

Take the money paid to the first debt and add it to the next debt move to the second smallest debt in your list and add the minimum payment plus extra money paid to the first debt to the.

How to recover from debt. Household debt has hit an all time high in north america, and is definitely a topic a lot of us can relate to. The debt avalanche method using this method, you’ll tackle the debt with the highest interest first. Ad credit cards maxed out?

To help reduce sleep debt, follow these tips: Our certified debt counselors help you achieve financial freedom. Ad one low monthly payment.

Cut debt by 50% or more. Debt recovery is not an easy thing to do. Sometimes that isn’t as easy as a phone call, in that case, begin by sending a letter.

Americans added an average of $1230 in credit card debt to their household budgets after the holiday season. Remember that it can take days to recover from a sleep debt. The letter should include |.

Get started in 5 mins. Pay down your debt with one easy monthly payment & no upfront fees. Generally 1 to 2 years is a reasonable amount of time to expect your credit to fully recover.

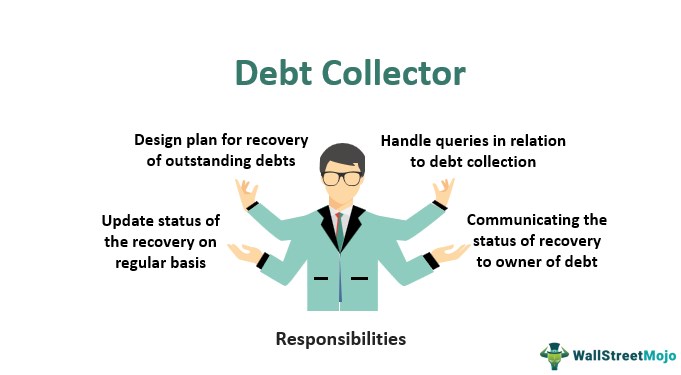

Offers online referral for consumers who are searching for debt relief options & solution. The first step of a debt recovery process is trying to contact the individual. How to recover your money from difficult debtors unfortunately, in business, if you offer credit, some customers will take advantage and try to push the payment terms.